There are 2 ways of using the Grid Trend Multiplier to make above average Gains:

It can be traded in a Non directional, Random market way

It can be traded in a single direction

The discussion below refers to the single direction strategy

The Single Direction strategy.

The Single Direction strategy.

Introduction

This approach is best used by an experienced Forex Traders who has a good feel the direction the market will tend to move. Sometimes a balance of Fundamental and Technical techniques can be used to identify a sustainable trend. The Grid Trend Multiplier is supplied a trading tool and not as a training course on finding direction and that is why we suggest that this approach is best used by experienced traders who can stop directional moves.

Using this strategy you would decide on

- a direction you want to trade

- an entry time

- an price level or time to exit

The time to exit is also critical as at any time during the trade, even when the trade is highly profitable, the price can retrace and go in the wrong direction and cause losses.

Risk Management

This approach also needs creative use of the risk management tools included in the EA.

These tools include:

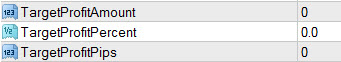

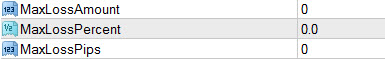

- Having Account Targets based $ gain, % gain number of pips gained.

- Having Account Stops based $ gain, % gain number of pips gained.

- Increasing grid sizes when the trades does against your direction

- Stop per deal

- Maximum number of open deals

These settings are discussed in more detail in another module specifically about risk management

Activating this strategy

Ignoring the risk management setting for now the basic setup for this strategy is:-

- Decide on the direction of trade

- Enable trades in that direction

- Enter the lot sizing, gap sizing your intend using

- Disable the trades in the other direction

- Enter the risk management setting you want to use as identified above.

And………….you are ready to trade.

Considerations when using the one direction approach are:-

Limiting damage

Using Gap Scaling

You want to limit the damage when the price moves against your selected direction but at the same time you need to give the multiplier room to move. How you would do this is use the 1. GapScalingAfterGridLevel and 2. GapScalingPct settings.

Possible settings could be:

1 for the AfterGridLevel setting and 10000% for the Pct setting. This will allow only 2 trades in the wrong direction at any time because the 10000% increase will increase the Gap to a point where the next transaction in the wrong direction will effectively not happen.

4 for the AfterGridLevel setting and say 50% for the Pct setting. If you are using a gap of 20 pips this will mean that your negative deals will have gaps of 20, 20, 20, 20,20,30,45…… and so on.

Using Maximum open trades

The other setting you can use is the MaxOpenTicketCount open deals setting but the disadvantage is that the EA will close the biggest negative and open the most recent trade. This could result in many negative deals due to the multiplier effect. If this is set to say 2 then with a gap of 20 you could end up with many losses of 40 + 20 = 60 that may not be made up positive cash ins.

Always bear in mind that it is possible to get a favourable result if the price action does not go in your intended direction as illustrated in this video

Therefore you do not want to over manage your risk management.

Using account profit and risk settings

The Profit and Risk settings are ideal for the one direction strategy and takes into account the fact that gains can be made in sideways markets and in markets that go against you. Using this approach allows you to give the multiplier as much room as possible to work so this is the preferred method of risk control.

You would simply set a $ account gain target, and a $ account loss target.

Start by calculating your max loss you want to encounter – Let’s say that it is $100.

Using the smallest lot size you can and using the Grid Trend Multiplier calculate how much money it would take to have say 5 to 10 open deals against you. You can use the risk management setting to limit the number of these deals. By dividing your potential loss in levels selected into the $100 you are prepared to lose you will get an initial transaction size to start.

Example:

- Gap size 10.

- Losses after 5 levels would be 50, 40, 30, 20, 10 = 150.

- $100 divided by 150 gives 6 micro lots (10c) per transaction. (Check = 150 x 6 x 10c = $90)

- So your initial transaction would be 0.06 lots.

- It would have to have at least 167 successful trades to make $100 (Check = 167transactions x 6 lots x 10c)

Please bear in mind that the 50 pip move against you, the stop out will only occur if the 50 pip negative move happens immediately. As the system goes on you will be adding positive trades all the time which will increase your margin of safety to effectively 60 pips and higher

Testing your settings

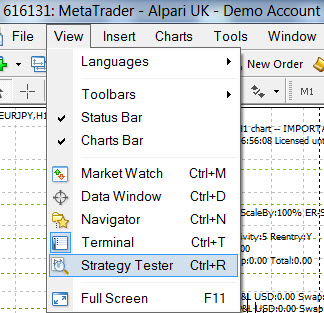

As this approach is best used by more experienced Forex traders the best way to find the settings that you are comfortable with is to use the MT4 Strategy tester to test and view the impact of the various setting over a period of as short as a day to longer ones.

How to use the Strategy Tester is outside of the scope of this article or the material supporting this EA. Experienced traders will know what to do to find the optimum setting for the strategy they want to employ.

Conclusion

The One Directional Grid Trend Multiplier option is best used by for Traders will self-management forex trading skills. If you do not have these skills it is recommended that you use the Non Directional Grid Trend Multiplier technique which can make profits no matter which direction the price action moves. This technique will be discussed in another module of the Grid Trend Trading Course.

If you have any questions or experiences please add them to the facility provided below.