Guide Settings for your Grid Trend Multiplier

It is always tricky using a trading Robot (Expert Advisor) for the first time and you are not always 100% sure how it should be set up. Below are some guides toward settings you could consider for the Grid Trend Multiplier.

These settings are based on using the Non Directional, Random Forex trading technique. They assume that an account of using 400:1 leverage. We do not recommend that you use an account with less leverage.

These setting are provided as guides and Expert4x assumes no responsibility for the results of using these settings - there is always a failure risk if the market trends excessively. Also never stop using your Forex trading experience and knowledge although this is an EA - always treat an EA as a trading tool.

Currency classification

Each of the settings below should be matched with currencies according to the risk posed by the different currencies. In general the bigger the potential range of a currency ,the riskier the currency when using small gaps when GTM trading

GROUP 1 - low range and volatility currencies

EURCHF, EURGBP, USDJPY, AUDNZD

GROUP 2 - medium range and volatility currencies

EURUSD, USDCAD, USDCHF, AUDUSD, GBPUSD, GBPCHF, EURCAD, NZDUSD, EURJPY

GROUP 3 - high range and volatility currencies

AUDJPY, GBPJPY, EURJPY, GBPUSD, NZDJPY, GBPNZD, EURNZD, GBPAUD, GBPCAD

General Comments on the settings below

- When trading the Non Directional Grid Trend Multiplier don't suggest you use the Account Risk control settings as it is better to withdraw gains than close the whole trading structure.

- When trading the Non Directional Grid Trend Multiplier don't suggest you use the Gap Scaling settings as they reduce with the multiplier efficiency

- The bigger the Gap used, the more risk is reduced, but more finance is required and the fewer times the multiplier will cash in successful trades.

- The Non directional strategy can either be traded until you receive a margin call or until you have made enough money. In both cases you would extract gains as and when they are made. Please use this link for more information. Random Strategy or Video

- Even using the Maximum Open deals setting which allows you to follow the trend there is a likelihood of any currency trending at some stage, so use and maintain an account that is not too big so that excess gains can be withdrawn regularly and that your losses will not be too big. Work on 1 loss account to 4 ones that generate gains.

- Please make sure you have a general understanding of how the Grid Trend Multiplier works and should be used by using the Articles and Videos on this link COURSE

- The GTM is traded in our PAMM account offering - the main difference in the PAMM trading is that no maximum open trade setting is used and that open deals are manually pruned more often - this produced optimal results.

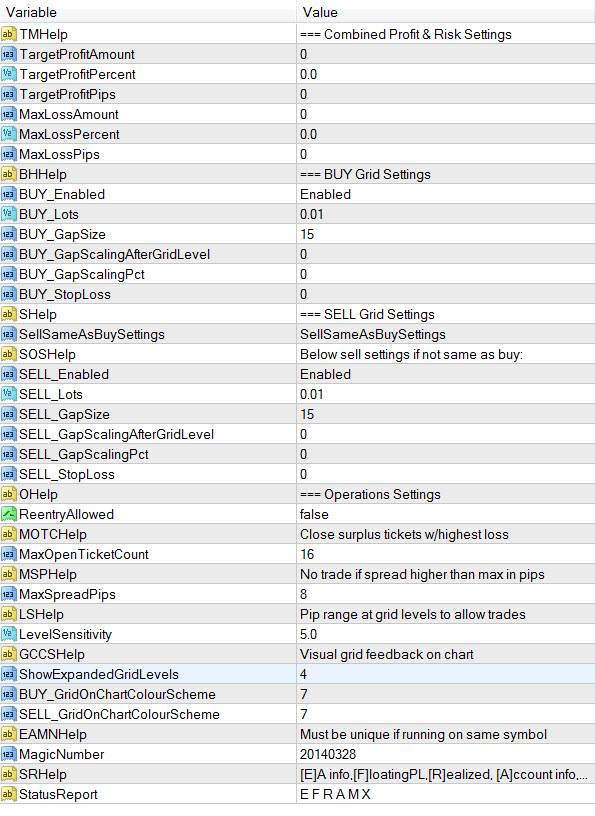

High frequency Cash in Strategy with a small range

The setting on the left are appropriate to the following assumptions:

Account size: $400 using 0.01 lot sizing

Trading Range envisioned: +/- 240 pips or 16 open trades

Funding used for trading range: $ 160

Possible Margin Call range: +/- 500 pips

Currencies:- Not recommended for Group 3 currencies

Aggressive for Group 2 currencies

Best used for Group 1 currencies

These settings provide good a good opportunity for the multiplier to cash in between 5 to 15 times day for GROUP 2 currencies and lower frequencies for GROUP 1 currencies.

In Summary: The setting on the left should be good for a $400 account that uses Group 1 or Group 2 currencies that are expected to trade in a range of 240 pips. It the currency starts trending and reaches 450 to 500 pips there is a strong chance of a margin call. If the currency stays in the anticipated range it should be profitable in 3 to 5 weeks when excess gains should be withdrawn in $100 batches.

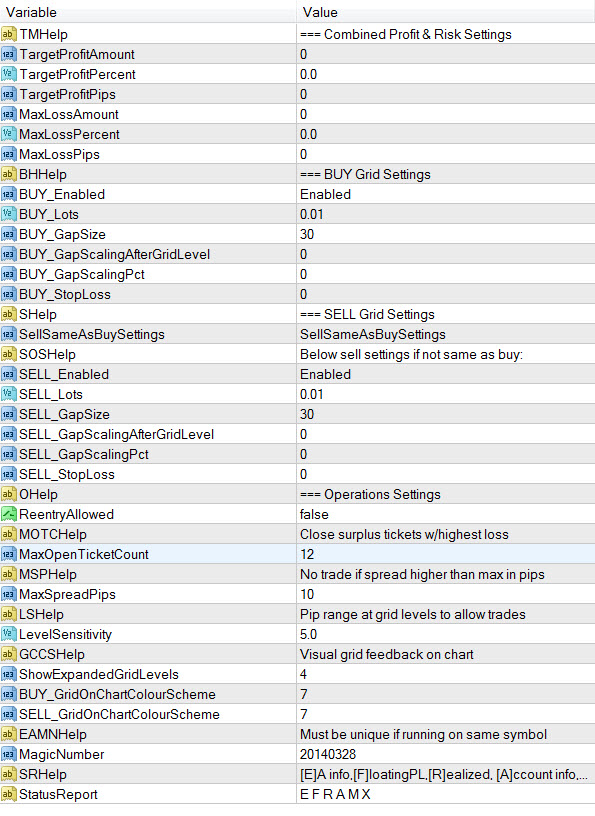

Medium frequency Cash in Strategy with a bigger range

The setting on the left are appropriate to the following assumptions:

Account size: $600 using 0.01 lot sizing

Trading Range envisioned: +/- 360 pips or 12 open trades

Funding used for trading range: $ 240

Possible Margin Call range: +/- 700 pips

Currencies:- Not recommended for Group 1 currencies

Aggressive for Group 3 currencies

Best used for Group 2 currencies

These settings provide good a good opportunity for the multiplier to cash in between 3 to 9 times day for GROUP 2 currencies and Higher frequencies for GROUP 3 currencies.

In Summary: The setting on the left should be good for a $600 account that uses Group 2 or Group 3 currencies that are expected to trade in a range of 360 pips. If the currency starts trending and reaches 700 to 800 pips there is a strong chance of a margin call. If the currency stays in the anticipated range it should be profitable in 3 to 5 weeks when excess gains should be withdrawn in $150 batches.

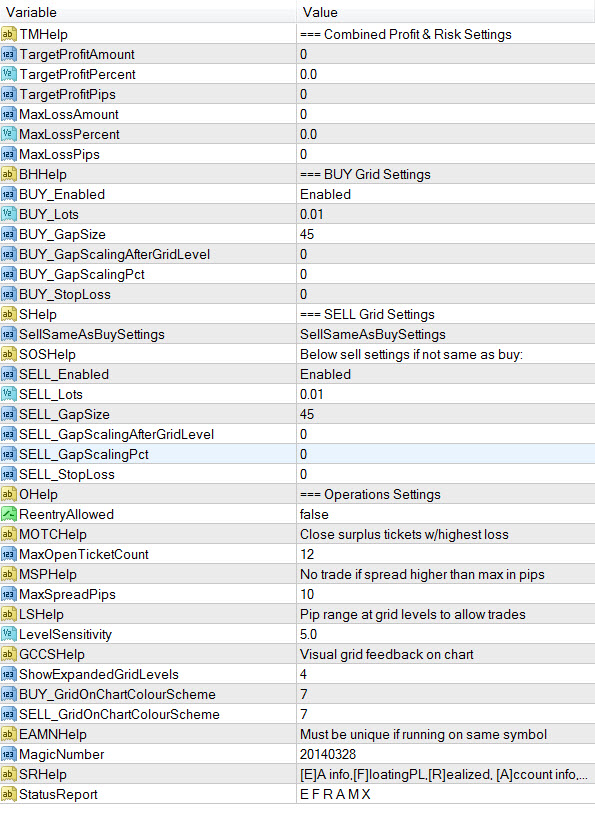

Low frequency Cash in Strategy with a larger range

The setting on the left are appropriate to the following assumptions:

Account size: $800 using 0.01 lot sizing

Trading Range envisioned: +/- 560 pips or 12 open trades

Funding used for trading range: $ 360

Possible Margin Call range: +/- 900 pips

Currencies:- Not recommended for Group 1 currencies

Conservative for Group 2 currencies

Best used for Group 3 currencies

These settings provide good a good opportunity for the multiplier to cash in between 2 to 6 times a day for GROUP 3 currencies and higher frequencies for GROUP 2 currencies.

In Summary: The settings on the left should be good for a $800 account that uses Group 2 or Group 3 currencies that are expected to trade in a range of 480 pips. If the currency starts trending and reaches 900 to 1000 pips there is a strong chance of a margin call. If the currency stays in the anticipated range it should be profitable in 3 to 5 weeks when excess gains should be withdrawn in $200 batches.

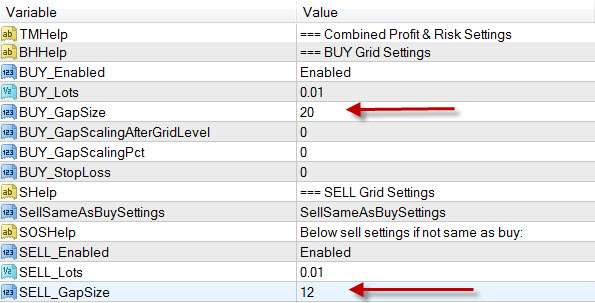

Some advanced settings for more experienced traders

To give your settings a bias in a certain direction you could increase the gap settings in the against the tend direction and decrease the Gap in the with the trend direction. This will give you more multiplier Cash ins in the direction of the trend.

We do not recommend that you change the buy or sell lots sizing. The Gap size difference will achieve much more.

Only use this option if you are confident about the long term direction of the price movement. It will not work if you constantly change gap sizes

Questions and Answers

Please send us any questions you may have about the above suggested settings

-

I get a Bonus from my Broker. Do I include that as part of my account balance?

I get a Bonus from my Broker. Do I include that as part of my account balance? It would be best to base your account size on the actual money deposited and exclude the bonus

DISCLAIMER and CAUTION

High Risk Investment Warning: Trading the Forex market on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade Forex offered by any Forex service provider or Broker you should carefully consider your objectives, financial situation, needs, and level of experience. By trading, you could sustain a total loss of your deposited funds. Before trading Forex you should be aware of all the risks associated with trading Forex products and read and consider any Financial Services Guides, Product Disclosure Statements, and Terms of Business issued by Brokers. Forex products are only suitable for those customers who fully understand the market risk. Most guidance given provides general advice that does not take into account your objectives, financial situation or needs. The content of this website must not be construed as personal advice. You should seek advice from a separate financial advisor.

Further, Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

At all times, any and all information on, or product or service purchased from, this website, is for educational purposes only and is under no circumstance intended to provide financial advice. No guarantee is represented from any statements about profits or income, whether expressed or implied. As no trading system is guaranteed, your actual trading may result in losses. You will at all times accept the full responsibilities for all of your trading actions, including but not limited to trades, profit or loss.

You agree to hold Expert4x.com and its group businesses, the site legal owners and employees and any authorized distributors of this information at all times harmless in any and all ways. By using our product(s) or services this constitutes your acceptance of our user agreement. Click Sales Inc. (ClickBank) is in no way associated or affiliated with any endorsement of prizes or allocation thereof in respect of any product or promotion appearing anywhere on this site. You agree by using this site and accepting our terms and conditions of purchase that you agree that you, and you alone, must ensure that the use of any of the materials purchased from our site in any manner or form at all, is in compliance with your national, local, federal, state or county laws. Trading in the financial markets is a high-risk and may result in the loss of all of your investment. Therefore the FOREX market and binary options may not be suitable for all investors . You should not invest money that you can not afford to lose. Before deciding to trade the beginning you should familiarize yourself with all the risks associated with trading and seek advice from an independent financial advisor. Under no circumstances will we be liable to any person or entity for : any loss or damage in whole or in part caused by, or related to any transactions related to binary options and FOREX, as well as being a result of such transactions any direct, indirect, special , consequential or incidental damages of any kind.