GRID TREND MULTIPLIER

What are the benefits of Pruning or setting maximum open trades?

Below are some calculations that may help you with your decision whether to Prune (to keep the open deals to a specified number) your open deals.

Please note:- the comment on this page apply only the Non Directional, Random, Grid Trend Multiplier strategy.

So here's the trading situation.

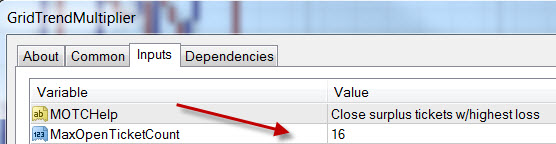

You have been trading the Grid Trend Multiplier and you have 16 open deals and it looks like there will be another open deal about to be added bringing the total to 17 open deals. The question is do you use the Maximum open deals setting to limit your open deals to 16 or do you let the open deals run.

IMPORTANT

The Maximum Open Deals setting will open a new deal but will also close the deal with the largest loss at the same time - thereby maintaining 16 open deals all the time. It is a way of trading with the trend.

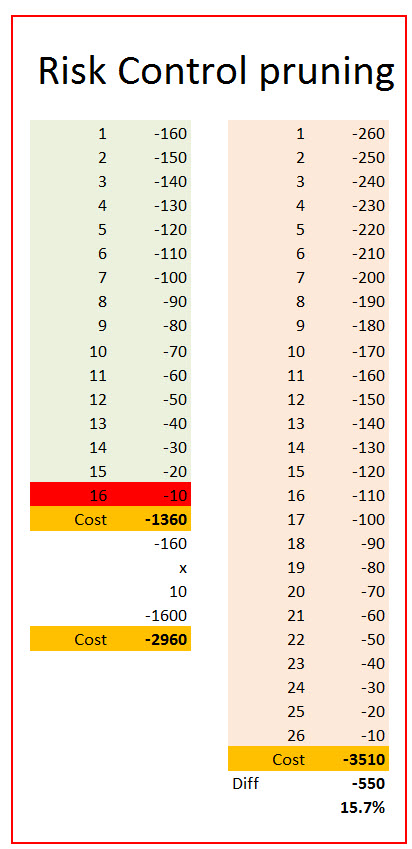

The the table on the left in green shows the financial situation in pips. The price is a the red level (level 16). The 16 open deals cost you 1 360 pips to have and only cover a range of 160 pips.

To Make this decision you have to do the numbers. Let's say that the price runs on for another 10 price levels what would the position be.

If you don't do anything the position is reflected in the table with the light orange colour. Your open deals will cost you 3 510 pips.

If you use the maximum open deals option the cost of your open deals will be 1 360 pips plus the negatives that you had to cash in to keep the open deals to 16 in number. 10 times -160 which is the value of the biggest negative deal closed 10 x 160 = 1 600. So the total cost is 2 960 pips.

550 pips better that the do nothing option

So not only does the Maximum Open Deals setting reduce the cost of you open deals but it also helps you trade with the trend.

But Wait it gets better

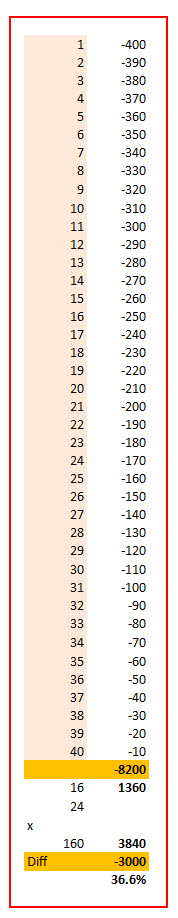

Taking the example above lets now project a price level move of 40 price levels.

Now the open deals will cost 8 200 pips !!! if left to run.

Using the maximum open trades setting limiting open trades to 16 the cost would be:-

- 16 open trades: the cost stays the same - 1 360 pips

- 24 closed trades at -160 per closed trade will amount to 3 840 pips.

So the total cost of having a 16 open trade blanket of open trades in this strong trend is 5 200 pip. A full 3 000 pips better (36%)

So the benefits of using the Maximum Open Trading setting are:-

- It reduces the cost of your open trades

- It allows you to trade with the trend

- It makes it more difficult to endure a margin Call.

Please Note: In order to give the multiplier enough room to move and work do not use the Maximum Open Deal setting for less than 14 to 20 open deals when trading the Non Directional, Random trading technique.

Setting the Maximum Open Trade setting

More Grid Trend Multiplier support training articles and videos may help you:

- Know how to size your account correctly VIDEO ARTICLE

- Know the risks involved VIDEO

- Know and understand the power of the multiplier VIDEO

- Know the appropriate settings to use for the 2 basic trading strategies. ARTICLE

- Know how to prune your open trades VIDEO IMPORTANT ARTICLE

- Know how to consult the GTM user guide when you are unsure about something GUIDE

- Know about GTM strategies VIDEO

- Know how you measure success when using the GTM VIDEO

- Know how you can double your account balance using the appropriate account size VIDEO

- Know how the GTM (previously the GTT) works VIDEO

- Know how to use risk Management for the ONE directional GTM strategy ARTICLE2