2 ways of using the Grid Trend Multiplier to make above average Gains

The Grid Trend Multiplier can be used in 2 ways

- It can be traded in a single direction

- It can be traded in a Non directional, Random market way

Ideally you want to trade the single direction technique in the direction of the trend a trending market and the non directional technique in a 700 to 300 pip ranging market.

Below we discuss the Non Directional technique

The Non-directional GTM strategy.

Introduction

The GTM non directional GTM Strategy is a unique and unusual Forex trading strategy. It has been designed to basically trade any financial market that trades in a reasonable range profitably.

It is successful because:-

- Firstly it follows a hedging approach where buy and sell directions are traded at the same time.

- Secondly it uses the powerful multiplier effect that often can allow trades taken in a sell direction to be positive even is the price has moved in a buy direction.

- Thirdly by trading both in a buy and sell direction the multiplier effect is in fact multiplied by 2

The biggest danger is a very quick and strong trend over 400 to 600 pips could be disastrous. A trend like that will not give the multiplier time to work and the system will fail.

When trading the non directional GTM strategy the Forex risk strategy is done by the multiplier itself and the hedging. They should over time generate enough income to compensate for loses. It is therefore best to not use any risk management approaches which will not allow the multiplier to work to its full potential.

So the general principles are:

- Use account sizing that will allow for the financing of at least 30 open trades.

- Only use risk management processes after 30 trades are open and there is a danger of more open trades developing. So the Maximum open deal setting should be used to avoid more than 30 open trades. It will allow the next trade but close the trade with the biggest loss.

- Ignore stops and variable grid sizing. They are mainly used for directional GTM trading.

So how can one manage risk? Risk can best be managed before the trading starts by appropriate

- grid size selection

- currency selection

- account sizing

Please use the links above for more information about these aspects

It is a natural for Forex traders to try to manage losses but experience and hundreds of back testing has proven that any intervention that impacts the multiplier from not working optimally is detrimental. The Maximum open deal setting has the least impact on the multiplier so that one is recommended as a last resort.

It is better to let the system fail and start again than to try and fight situations that will eventually fail. That is why a 5 bullet approach (using 20% of your capital at a time) is recommended.

That does not prevent you from using any of the risk management tools available on the Grid Trend Multiplier the way you feel appropriate to your own risk management philosophy.

When Does the Non Directional Strategy stop.

So you start trading the Grid trend Multiplier and it starts opening a blanket of open deals. So when does it stop – when can you cash in all your deals?

There are 3 approaches:-

- Trade the GTM until you have a margin call. Hopefully during the time it is trading you will have many opportunities to withdraw you original capital and even some great profits. Just set the Maximum open deals and literally set and forget except for withdrawing surplus funds. Surplus funds are normally when your gains exceed your open trades by +/- 25% to 50% of your original capital.

- Close all the trades when you think you have cashed in a sufficient number of time and you are highly profitable. The timing of this is a personal decision.

- The market will start trending soon after you started or at some time during your PAMM which will not give the Multiplier time to work and you will get a planned margin call. That is the best stop out because you have given the multiplier all the time to succeed and it didn’t – it is not a disaster if you are using the 20% of total capital approach.

A practical example

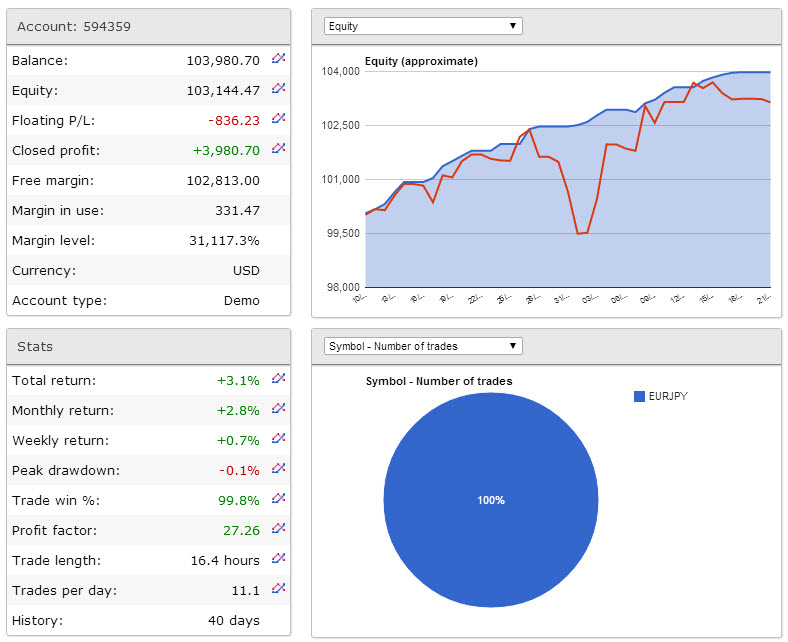

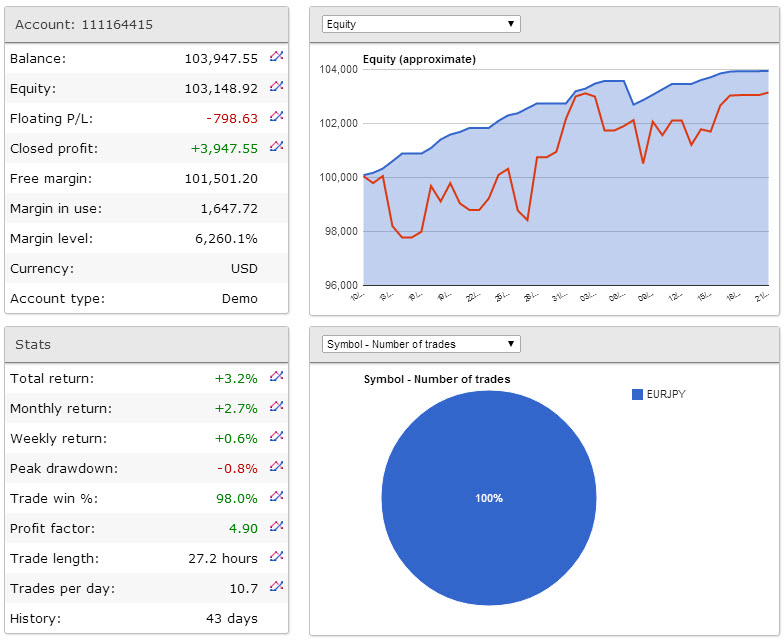

There are 2 test trading accounts that reflect non directional trading. These were opened under the GTT format so there are 2 separate accounts. Under the GTM format these would be consolidated in 1 account.

At the time of writing both the Buy and Sell legs were positive. These have no restrictions whatsoever except that at some stage there was some minor pruning done.

The gain produced are well over 150% of $ 4 000 (The optimal capital for this particular strategy although $100 000 was used in the demo account). So the trader could have withdrawn say $150% of his original capital making a 50% gain already and could leave the accounts to do what they want to do and create either more withdrawal

Gains $3144 + $3148 = $ 6292

Only $4000 is required per 0.1 lots at 400:1 gearing

So $ 6000 can be withdrawn and the accounts left to continue with the risk of a margin call which would result in a net gain of $2 000 ($6000 gain withdrawn less $4000 margin call).

Or the trader can close everything and walk away with a $ 6 292 realised gain

What would you do??

Looks exceptionally good Alex, will enter soon as I have the funds!

Alex, I have a question. You said the main danger of using the non-directional technique is an unexpected long trend. You gave an example of 400 – 600 pips which you also stated could be devastating. I certainly understand that and would agree with you. What I am wondering is, are there ways to determine when is the best time to turn on the EA? To me, logically, the ideal place to turn on the EA would be in the middle of the trend. Of course you can’t determine the middle of the trend until it’s actually over. So, would it be good to wait until the trend is over and try to turn on the EA, say on a 50% retracement or somewhere close to the middle of the last major trend. Also, what about time frames, a trend in a 15 minute chart might only be only a small retracement say in a 4 hour chart. Should time frames be considered? This has always been a bit unclear to me. Your answer is appreciated. By the way, I have already had very good success using the non-directional method of trading. Every time I make $500, I remove it and put it into my Forex Trading Bank Account so I will always have money to restart my account in the case of a margin call. I am following your personal method of trading the non-directional method. Thanks for sharing that method, it sure works well! Just wanted to say thank you for such a great EA.

Hi Robert Thanks for that feedback –

big trends are mainly driven by fundamentals so keep a lookout important news. Also watch the relative strength of currencies. It is good to trade the strongest against the weakest when trading the directional way. Avoid the strongest against the weakest crosses as they are more likely to trend for the non directional method.

The weekly and daily charts are best used to determine likely trends and likely trading ranges. There is no known way of accurately and constantly determining the start and strength of a particular trend. So best to use the 20% approach promoted at in this video https://www.youtube.com/watch?v=gSd6HHZzQO4&feature=share&list=UUw5NuBE-K4qo6eJzyO1bT6g&index=1. which you are already using.

The ideal time to activate the EA is in the middle of the range you expect it to trade in in the next few weeks/months. This is not always possible because of the number of unknowns

Alex